Financial Assistant: Your Partner in Building a Secure Future

Streamline Your Financial Trip With Trusted and Efficient Car Loan Solutions

Trusted and reliable car loan solutions play a pivotal role in this procedure, supplying individuals a reputable course in the direction of their financial goals. By understanding the benefits of functioning with trustworthy lenders, checking out the different kinds of financing services available, and developing in on vital factors that determine the best fit for your requirements, the course to economic empowerment comes to be more clear - mca loans for bad credit.

Benefits of Relied On Lenders

When seeking economic support, the advantages of selecting trusted lending institutions are vital for a secure and trusted borrowing experience. Relied on lenders use transparency in their conditions, providing debtors with a clear understanding of their responsibilities. By dealing with credible lenders, debtors can avoid concealed costs or aggressive techniques that could cause monetary challenges.

Furthermore, trusted lenders commonly have actually established connections with governing bodies, ensuring that they operate within legal borders and stick to industry requirements. This conformity not just protects the customer however likewise cultivates a feeling of trust and integrity in the lending procedure.

Additionally, trusted loan providers focus on customer support, offering support and guidance throughout the borrowing journey. Whether it's clearing up finance terms or aiding with payment options, trusted lending institutions are dedicated to helping debtors make knowledgeable economic decisions.

Kinds of Lending Services Available

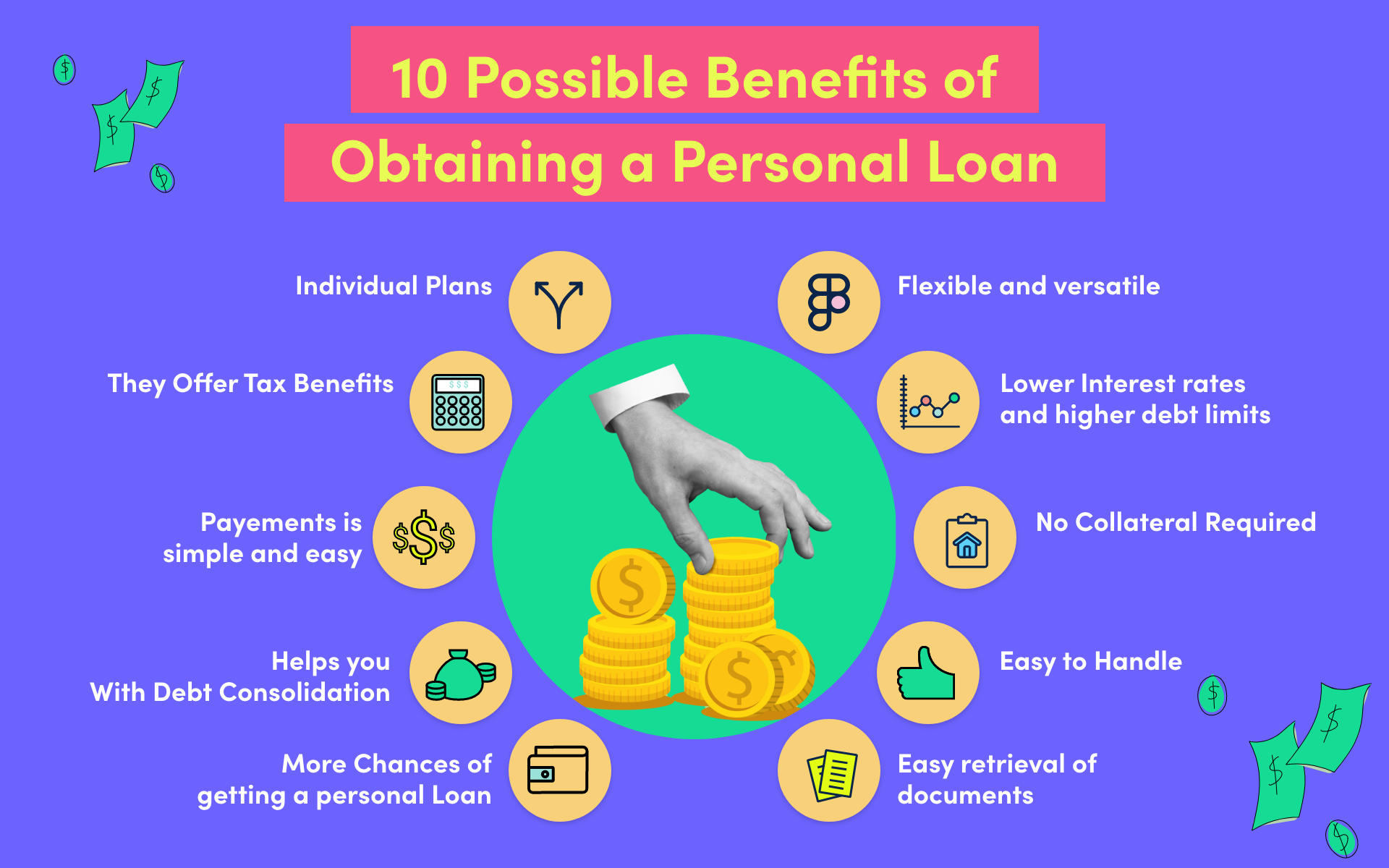

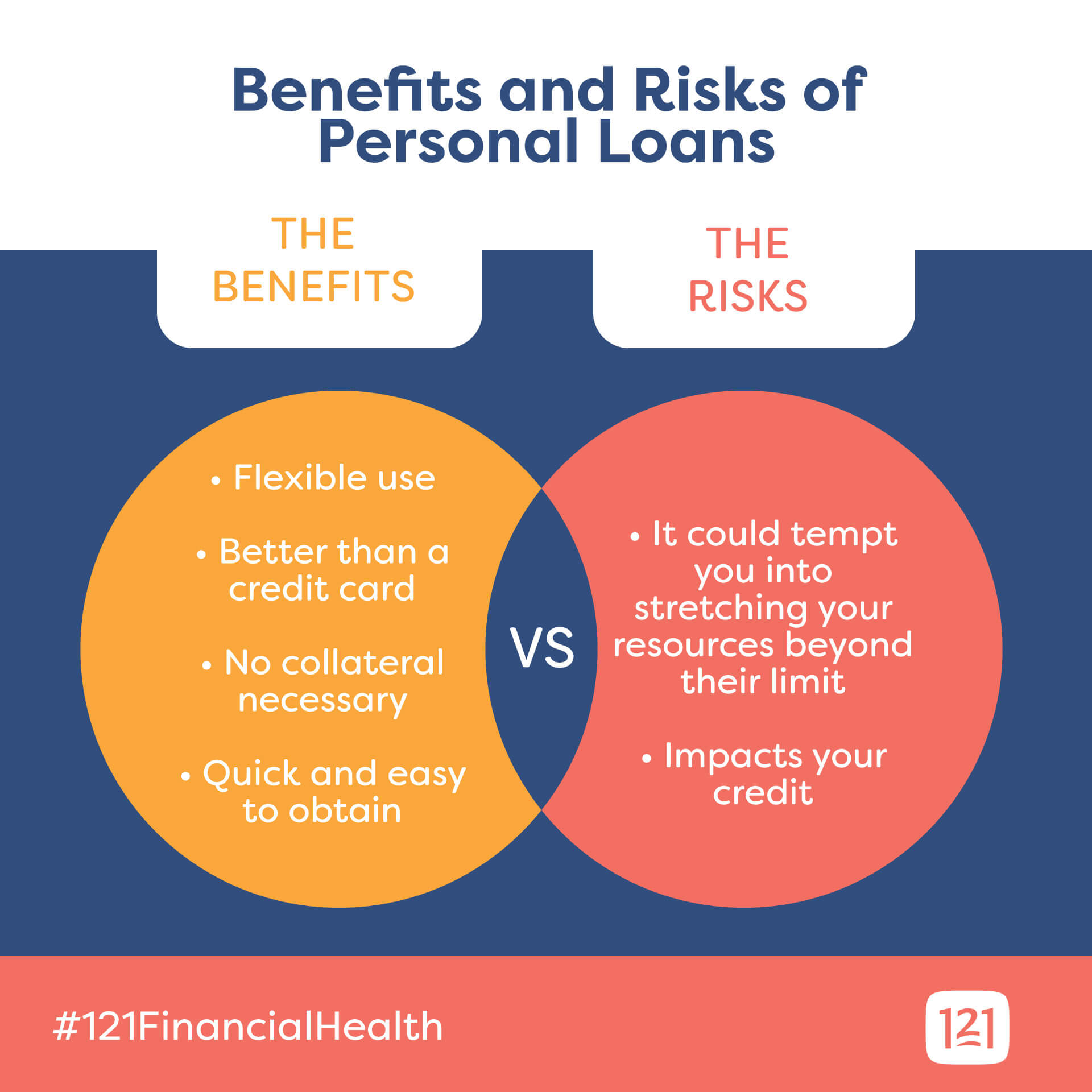

Various banks and borrowing firms use a diverse variety of lending solutions to provide to the differing requirements of customers. Some of the usual kinds of funding services available consist of personal fundings, which are usually unsecured and can be utilized for different purposes such as financial debt combination, home remodellings, or unexpected expenditures. Home loan car loans are specifically created to assist individuals acquire homes by offering significant quantities of money upfront that are repaid over a prolonged period. For those aiming to purchase a vehicle, vehicle finances provide a means to finance the purchase with fixed regular monthly payments. Furthermore, business finances are available for business owners seeking funding to begin or broaden their endeavors. Student financings satisfy educational costs, giving funds for tuition, books, and living costs throughout academic searches. Understanding the different kinds of car loan solutions can help customers make educated decisions based on their certain financial requirements and objectives.

Variables for Choosing the Right Loan

Having actually familiarized oneself with the varied range of loan services offered, consumers need to meticulously examine key aspects to select the most appropriate loan for their details financial demands and purposes. Comprehending the settlement timetable, fees, and charges linked with the car loan is crucial to prevent any kind of shocks in the future - merchant cash advance loan same day funding.

Moreover, consumers must review their existing financial scenario and future potential customers to identify the loan quantity they can comfortably manage. It is recommended to obtain only what is essential to lessen the financial problem. Additionally, evaluating the lender's track record, customer support, and total transparency can add to a smoother borrowing experience. By meticulously thinking about these variables, customers can pick the right finance that aligns with their monetary goals and capabilities.

Simplifying the Lending Application Process

Effectiveness in the financing application procedure is paramount for guaranteeing a seamless and expedited borrowing experience. To streamline the funding application procedure, it is crucial to give clear guidance to applicants on the required documentation and information - Loan Service. Utilizing online systems for application entries can significantly reduce the moment and effort involved in the process. Implementing automated systems for verification of documents and debt checks can expedite the application testimonial procedure. Using pre-qualification choices based on basic details given by the candidate can assist in straining disqualified prospects early. Offering regular updates to candidates on the condition of click for source their application can improve transparency and consumer contentment. Additionally, simplifying the language used in application and interaction materials can promote much better understanding for applicants. By incorporating these structured processes, loan providers can use a much more efficient and straightforward experience to borrowers, inevitably enhancing total client satisfaction and commitment.

Tips for Effective Loan Repayment

Browsing the path to effective finance payment requires mindful planning and regimented monetary management. To ensure a smooth payment journey, beginning by creating a thorough budget plan that includes your car loan settlements. Comprehending your income and costs will assist you allocate the needed funds for timely payments. Consider establishing automatic repayments to avoid missing out on target dates and incurring late costs. It's also a good idea to pay greater than the minimum amount due every month if possible, as this can help in reducing the general interest paid and shorten the payment duration. Prioritize your finance repayments to prevent back-pedaling any financings, as this can negatively affect your credit report and financial stability. In situation of economic difficulties, communicate with your loan provider to discover possible alternatives such as funding restructuring or deferment. By staying arranged, aggressive, and financially disciplined, you can successfully navigate the procedure of settling your lendings and accomplish higher economic liberty.

Conclusion

In verdict, using relied on and effective car loan solutions can considerably simplify your economic journey. By very carefully selecting the appropriate loan provider and type of finance, and improving the application procedure, you can ensure an effective loaning experience.